India has solidified its position as the global leader for Global Capability Centers (GCCs), with over 1,700 centers contributing $64.6 billion to the economy as of 2024. This remarkable growth isn’t just due to India’s skilled talent pool and cost advantages—it is also strongly backed by Government Support through progressive policies, incentives, and a business-friendly ecosystem designed to attract multinational enterprises.

Understanding India’s GCC tax benefits is crucial for multinational corporations considering expansion or optimization of their existing operations. With strong Government Support, India offers one of the world’s most attractive tax environments for global capability centers, ranging from 100% income tax exemptions in Special Economic Zones to GST benefits on export services, making long-term investment both strategic and cost-effective.

Understanding India’s Tax Framework for GCCs

Corporate Tax Structure: Competitive Rates That Drive Growth

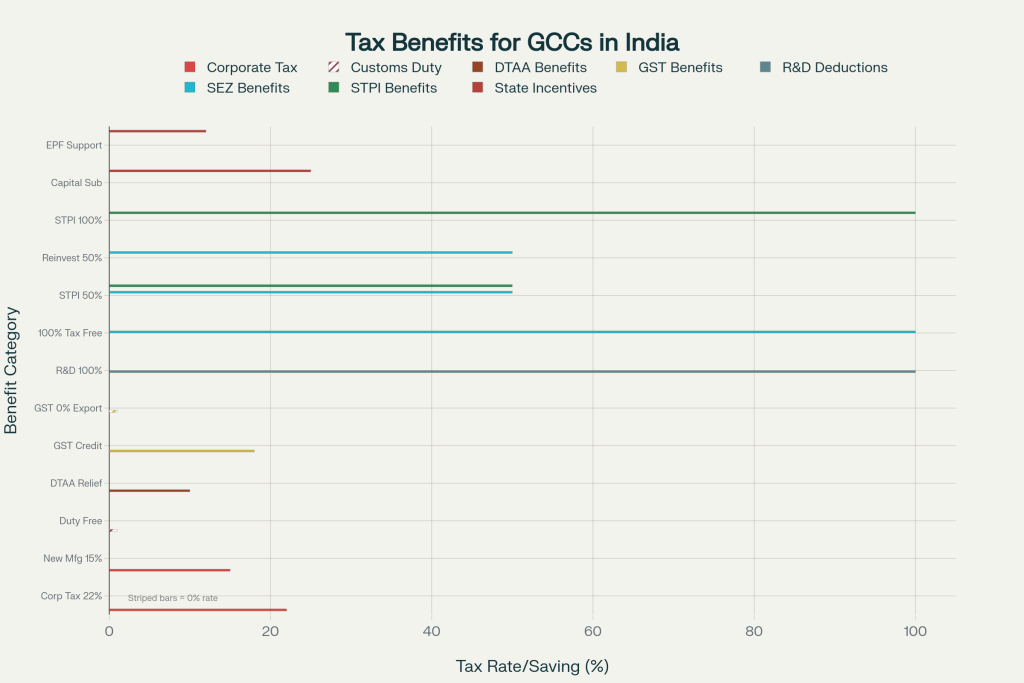

India’s corporate tax regime offers significantly lower rates compared to many global competitors, making it an attractive destination for GCC investments:

Standard Corporate Tax Rates:

- 22% for domestic companies (compared to 30% previously)

- 15% for new manufacturing entities established after October 1, 2019

- 35% for foreign companies (reduced from 40% in 2024)

- Additional surcharge and cess may apply based on income levels

Strategic Tax Planning Benefits:

The choice between establishing a Private Limited Company versus Limited Liability Partnership significantly impacts tax efficiency. PLCs offer an effective tax rate of 25.17% compared to 34.94% for LLPs, making the corporate structure more tax-efficient for most GCC operations.

Direct Tax Advantages: Maximizing Operational Efficiency

India’s direct tax framework provides multiple avenues for tax optimization:

Export-Oriented Tax Benefits:

GCCs providing services to global markets benefit from reduced tax liabilities through various export promotion schemes. These benefits are particularly valuable for centers engaged in IT services, research and development, and financial analytics.

Advance Pricing Agreements (APAs):

To provide certainty in transfer pricing, India offers Advance Pricing Agreements that allow GCCs to pre-agree on pricing methodologies with tax authorities, reducing compliance costs and audit risks.

Special Economic Zones (SEZs): The Crown Jewel of Tax Benefits

Comprehensive SEZ Tax Exemptions

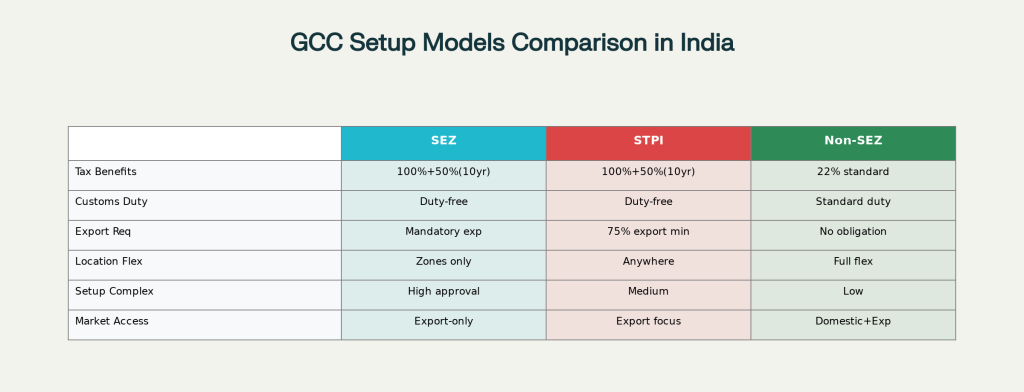

Special Economic Zones represent the most lucrative tax incentive structure available to GCCs in India:

Income Tax Holidays:

- 100% income tax exemption on export profits for the first five years

- 50% exemption for the subsequent five years

- Additional 50% exemption on reinvested export profits for another five years

- No minimum alternate tax (MAT) for SEZ units during the exemption period

Customs and Duty Benefits:

Recruit the top 1% of global talent today!

Access exceptional professionals worldwide to drive your success.

- Zero customs duties on imported equipment, software, and raw materials

- Duty-free imports of capital goods and IT infrastructure

- No central sales tax on goods supplied to SEZ units

- Service tax exemptions for services provided within SEZs

Operational Advantages Beyond Tax Savings

SEZs offer streamlined business operations through:

Single-Window Clearances:

All regulatory approvals are processed through a unified approval mechanism, significantly reducing bureaucratic delays and setup time.

Infrastructure Benefits:

SEZ developers provide world-class infrastructure, including reliable power supply, high-speed internet connectivity, and modern office facilities, reducing operational setup costs.

Software Technology Parks of India (STPI): Flexible Tax Optimization

STPI Scheme Benefits

The STPI scheme provides operational flexibility while maintaining substantial tax advantages:

Tax Exemption Structure:

- 100% tax holiday on export profits for the first five years

- 50% exemption for the next five years

- Single-window clearance for all approvals, reducing compliance complexity

- Location flexibility – STPI units can operate anywhere in India

Import Duty Benefits:

- Duty-free imports of hi-tech equipment and machinery

- Indirect tax benefits on IT infrastructure procurement

- Customs duty waivers on essential business equipment

Export Compliance Requirements

STPI units must maintain 75% export orientation to qualify for tax benefits, making this scheme ideal for GCCs focused on serving global markets.

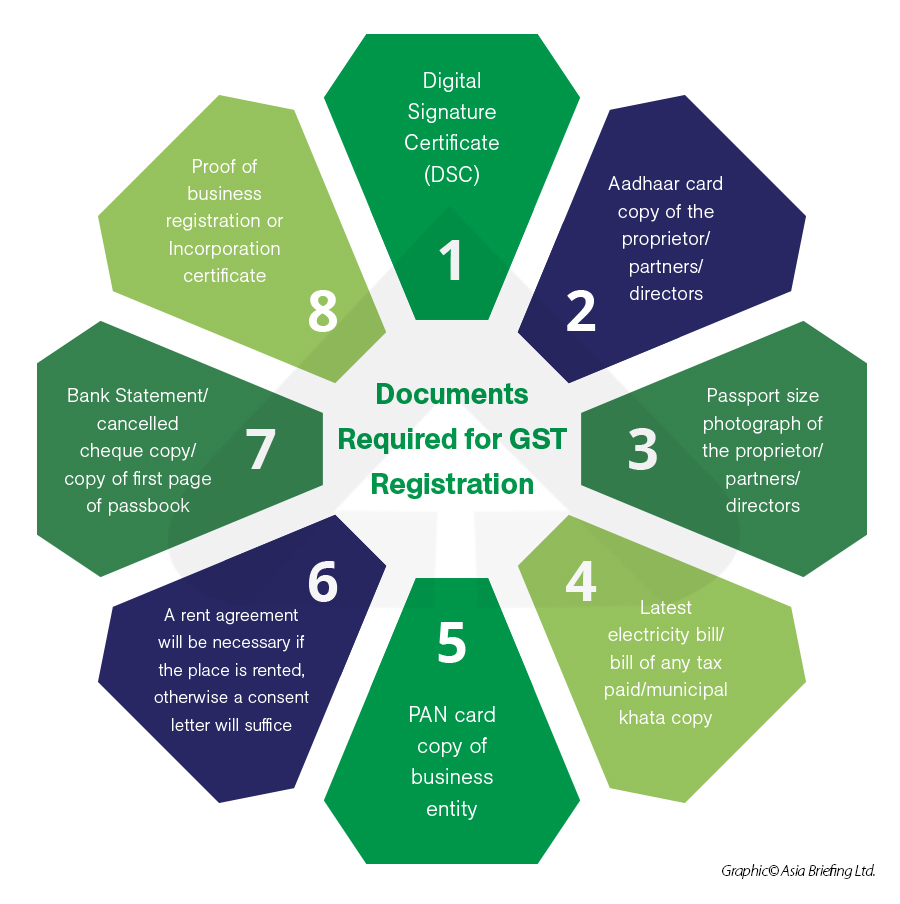

GST Benefits: Streamlining Indirect Tax Obligations

Zero-Rated Export Supplies

Under India’s Goods and Services Tax (GST) regime, GCC services qualify for significant benefits:

Export Service Benefits:

- Zero-rated GST on services provided to foreign clients

- Input Tax Credit (ITC) recovery on business expenses

- Automated refund mechanisms for IGST paid on exports

- No GST liability on export invoices

GST Compliance Options

GCCs have two strategic options for GST compliance:

Option 1: Export under Letter of Undertaking (LUT)

- Export services without paying GST

- Claim refunds of unutilized input tax credits

- Faster cash flow with no upfront tax payments

Option 2: Export with GST Payment and Refund

- Suitable for companies preferring systematic refund processes

- Pay GST on export invoices initially

- Claim automated refunds through the GST portal

Transfer Pricing Benefits: Safe Harbor and Compliance Simplification

Safe Harbor Rules: Reducing Compliance Burden

India’s Safe Harbor provisions provide predetermined profit margins for eligible GCC transactions:

Eligible Services and Margins:

- IT-enabled services: Specified operating margins reduce audit scrutiny

- Software development services: Predetermined acceptable profit ranges

- R&D services: Safe harbor treatment for innovation-focused activities

- Reduced documentation requirements for qualifying transactions

Recent Updates (2025):

The Central Board of Direct Taxes has extended Safe Harbor Rules to FY 2024-25 and FY 2025-26, providing continued compliance relief for qualifying GCCs.

Double Taxation Avoidance Agreements (DTAA)

India’s extensive DTAA network with 90+ countries provides significant benefits:

Key DTAA Advantages:

- Foreign tax credit relief for taxes paid in other jurisdictions

- Lower withholding tax rates on international payments

- Reduced tax on royalty and technical fees

- Capital gains tax relief for equity investments

Research and Development Tax Deductions

Section 35: Incentivizing Innovation

India’s Section 35 of the Income Tax Act provides substantial deductions for GCCs engaged in R&D activities:

R&D Tax Benefits:

- 100% deduction on revenue expenditure for scientific research

- 100% deduction on capital expenditure (excluding land)

- Enhanced deductions for payments to approved research institutions

- 200% weighted deduction for DSIR-approved in-house R&D (till March 2017)

Eligible R&D Activities:

- Software development and technological innovation

- Engineering and natural sciences research

- Applied research and experimental development

- Collaboration with academic institutions and research centers

State-Level Tax Incentives: Regional Advantages

Karnataka’s Pioneer GCC Policy

Karnataka, as the first state to launch a dedicated GCC policy, offers attractive incentives:

Beyond Bengaluru Incentives:

- 50% rental reimbursement, capped at ₹2 crore

- EPF contribution reimbursement of ₹3,000 per employee monthly for two years

- 25% internet expense reimbursement for three years

- Property tax relief of 30% for three years

Uttar Pradesh’s Comprehensive Framework

UP’s GCC Policy 2024 targets establishing over 1,000 centers:

Financial Incentives:

- 25% capital subsidy on Eligible Capital Investment, up to ₹25 crore

- 100% land subsidy complete exemption on land purchase

- 5% interest subsidy on term loans up to ₹1 crore annually

- 20% operational subsidy on operating expenses including rentals

Other State Initiatives

Telangana: Capital subsidies and tax exemptions for IT-enabled services

Maharashtra: Infrastructure grants and SEZ development support

Tamil Nadu: Fiscal incentives for digital infrastructure in tier-2 cities

Compliance Requirements: Ensuring Tax Benefit Eligibility

Mandatory Filing and Documentation

GCCs must maintain comprehensive compliance to qualify for tax benefits:

Essential Tax Filings:

- Annual income tax returns (Form ITR) with proper documentation

- Quarterly advance tax payments to avoid interest penalties

- Transfer pricing documentation for related-party transactions

- GST returns (monthly or quarterly based on turnover)

SEZ-Specific Compliance

For SEZ-based GCCs, additional requirements include:

Documentation Requirements:

- Separate financial records for SEZ and domestic operations

- Export performance tracking and periodic reporting

- Annual SEZ compliance reports to Development Commissioner

- Bank account segregation for export proceeds

Maximizing Tax Benefits: Strategic Planning

Choosing the Optimal Structure

The selection between SEZ, STPI, and Non-SEZ models depends on business objectives:

SEZ Model: Best for export-oriented GCCs seeking maximum tax benefits

STPI Model: Ideal for IT services with location flexibility requirements

Non-SEZ Model: Suitable for hybrid operations serving domestic and global markets

Professional Tax Advisory

Given the complexity of India’s tax landscape, engaging experienced tax professionals is crucial:

Advisory Services:

- Transfer pricing compliance and optimization

- Tax structure planning and entity formation

- Regulatory approval and licensing support

- Ongoing compliance and audit preparation

Recent Updates and Future Outlook

New Income Tax Act 2025

India’s Income Tax Act 2025, effective from April 1, 2026, introduces several changes:

Key Changes:

- Streamlined tax structure with clearer provisions

- Reduced compliance burden for multinational operations

- Enhanced digital compliance mechanisms

- Transfer pricing provisions with simplified definitions

MeitY’s National GCC Framework

The Ministry of Electronics and Information Technology is developing a comprehensive national framework to promote GCCs in tier-2 cities:

Strategic Focus:

- Innovation-focused incentives rather than purely cost-based benefits

- Talent development programs for emerging technologies

- Regulatory harmonization across states and central government

- Single-window clearances for GCC establishment

Best Practices for Tax Optimization

Proactive Tax Planning

Successful GCC tax optimization requires strategic planning:

Planning Strategies:

- Early engagement with tax authorities for clarifications

- Regular compliance audits to ensure benefit eligibility

- Documentation management for transfer pricing requirements

- Scenario planning for different operational models

Leveraging Technology

Modern GCCs should implement digital tax compliance systems:

Technology Benefits:

- Automated GST calculations and filings

- Real-time transfer pricing documentation

- Compliance monitoring and alert systems

- Integration with global tax reporting frameworks

Conclusion: Maximizing India’s GCC Tax Advantage

India’s comprehensive tax incentive framework makes it the most attractive global destination for GCC investments. With SEZ benefits providing up to 15 years of tax holidays, GST exemptions on export services, and state-specific incentives offering operational cost reductions, businesses can achieve substantial tax savings while accessing world-class talent and infrastructure.

The key to maximizing these benefits lies in strategic planning and proper compliance. Whether choosing SEZ operations for maximum tax holidays, STPI registration for operational flexibility, or leveraging R&D deductions for innovation-focused activities, GCCs must align their tax strategy with business objectives.

As India continues to evolve its GCC policy framework, with the upcoming national GCC framework from MeitY and implementation of the new Income Tax Act 2025, businesses that establish compliant, well-structured operations today will be best positioned to capitalize on future enhancements.

For multinational corporations considering GCC establishment or expansion in India, the current tax environment presents an unprecedented opportunity to achieve operational excellence while optimizing global tax efficiency. The combination of substantial tax benefits, skilled talent availability, and government support creates a compelling value proposition that positions India as the undisputed global leader in the GCC ecosystem.

Professional guidance from experienced tax advisors and compliance experts is essential to navigate this complex but rewarding landscape and ensure full realization of available benefits while maintaining regulatory compliance.