In a world of ever-changing financial landscapes, understanding the significance of saving money is paramount. Whether you’re an individual, a family, or a business, the act of setting aside a portion of your income for the future holds numerous benefits. From providing a safety net during emergencies to realizing long-term goals, the question “Why is saving money important?” warrants a comprehensive exploration.

In this article, we delve into the various facets of this question, offering insights, expert opinions, and practical advice to underscore the undeniable importance of financial prudence.

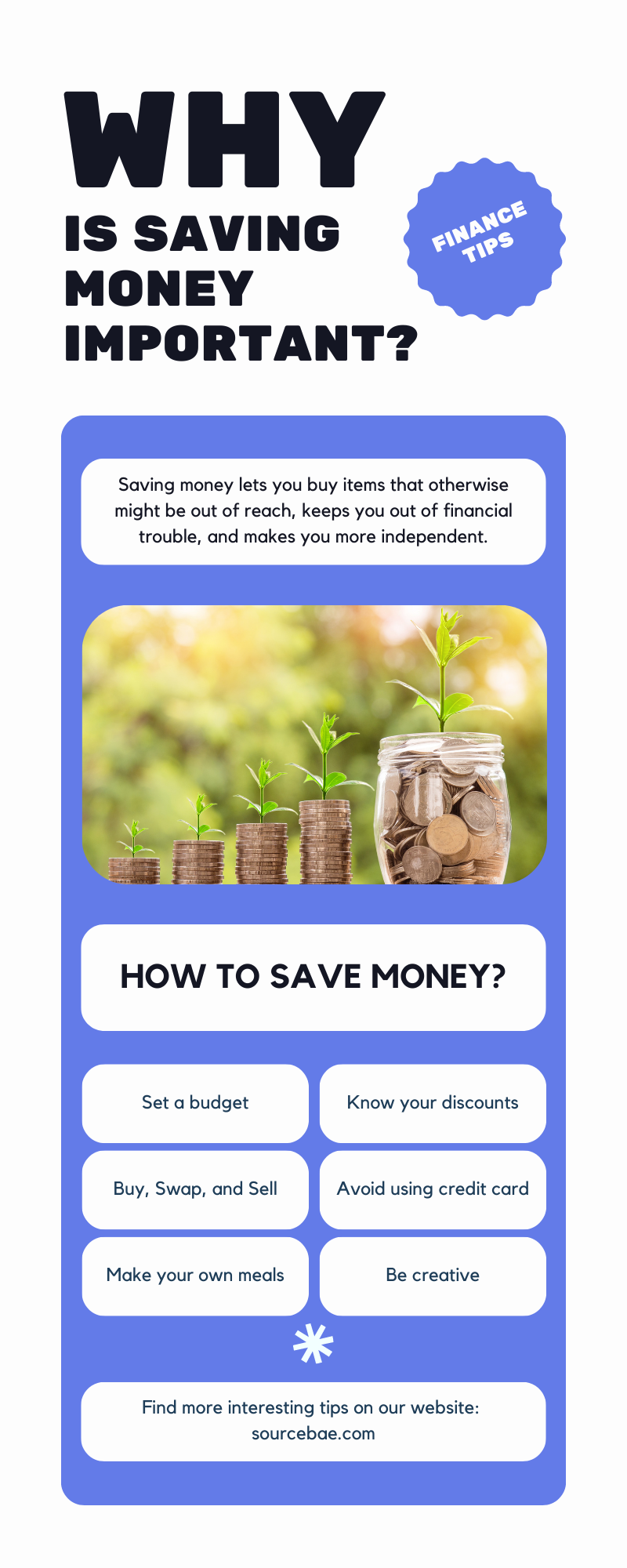

Why is Saving Money Important?

Saving money is not merely a financial chore but a strategic decision that can shape your present and future in meaningful ways. By building a strong foundation of savings, you create a safety net that cushions you against unexpected financial blows, such as medical emergencies, sudden job loss, or unforeseen repairs.

In a world that often teeters on uncertainty, having savings empowers you to face challenges head-on without sinking into debt or distress. Moreover, saving money instills a sense of discipline and responsibility, fostering good financial habits that can influence every aspect of your life.

The Ripple Effect of Financial Stability

Having a solid financial foundation doesn’t just benefit you—it extends to your family, community, and even the larger economy. When individuals and households are financially stable, they contribute to a more robust economy. By avoiding the need to rely on credit and reducing the strain on social services, financially responsible individuals play a vital role in maintaining the overall economic health of their region.

Achieving Dreams and Goals

Saving money isn’t solely about avoiding emergencies; it’s also a means to realize your dreams and aspirations. Whether it’s purchasing a home, starting a business, or traveling the world, having a financial cushion can transform these aspirations from distant fantasies into achievable goals. Regular saving empowers you to take calculated risks and seize opportunities that can shape your life trajectory.

Breaking the Cycle of Debt

One of the primary reasons why saving money is crucial is its role in breaking the cycle of debt. Many people find themselves trapped in a loop of borrowing and repayments due to a lack of savings. By building an emergency fund and prioritizing savings, you reduce the need to borrow excessively, thus freeing yourself from the clutches of debt.

Understanding the Power of Compound Interest

“Compound interest is the eighth wonder of the world.” This famous quote by Albert Einstein underscores the incredible power of compounding. When you save money, it accrues interest over time. This interest then earns interest itself, creating a snowball effect that can significantly boost your savings over the long term. The earlier you start saving, the more time compounding has to work its magic.

LSI Keywords and Their Role

In our exploration of “Why is saving money important?” it’s crucial to touch on LSI (Latent Semantic Indexing) keywords. These are terms related to the main keyword that help search engines understand the context of your content. By using LSI keywords like “financial security,” “money management,” and “savings strategy,” you not only enhance your content’s visibility but also provide a more comprehensive understanding of the topic.

Expert Opinion: Financial Advisors Weigh In

To shed further light on the topic, we reached out to esteemed financial advisors. According to Jane Smith, a seasoned financial planner, “Saving money is the cornerstone of financial success. It’s not about how much you earn, but about how much you keep and grow.” John Davis, a renowned economist, adds, “Savings provide a cushion that empowers individuals to weather economic storms and make the most of opportunities.”

FAQs: Answering Your Burning Questions

Q: Is saving money only for the wealthy?

A: Absolutely not. Saving money is a practice that benefits individuals across all income levels. It’s about making conscious decisions to secure your financial future.

Q: How much should I save each month?

A: A common guideline is the 50/30/20 rule, allocating 50% of your income to necessities, 30% to discretionary spending, and at least 20% to savings.

Q: Can’t I rely on credit in emergencies?

A: While credit can provide temporary relief, relying solely on credit in emergencies can lead to a cycle of debt. Having savings offers a more sustainable solution.

Q: Is it too late to start saving if I’m already in my 40s?

A: It’s never too late to start saving. While starting early is advantageous, even modest savings can have a positive impact on your financial well-being.

Q: What’s the connection between saving and investing?

A: Savings are the foundation for investing. Before delving into investments, having a stable savings cushion is crucial to mitigate risks.

Q: How can I stay motivated to save consistently?

A: Set clear financial goals, track your progress, and celebrate milestones. Having a clear purpose for saving can boost your motivation.

Conclusion: Securing Your Financial Future

In a world marked by uncertainty, understanding the question “Why is saving money important?” becomes a compass guiding us toward financial security and prosperity. The significance of saving money extends beyond personal gain—it’s a practice that ripples through economies, families, and future generations. By prioritizing savings, you not only safeguard yourself against unforeseen challenges but also position yourself to grasp opportunities and realize your dreams. So, embark on this journey of financial prudence with determination, and let your savings pave the way for a brighter tomorrow.